Adjusted Trial Balance to Income Statement: Simplified Guide

Transitioning from an adjusted trial balance to an income statement is a critical step in the accounting process. It helps businesses understand their financial performance over a specific period. This guide simplifies the process, ensuring you can accurately prepare an income statement from your adjusted trial balance. Whether you're a small business owner or an accounting professional, mastering this skill is essential for financial clarity. (adjusted trial balance, income statement, financial performance)

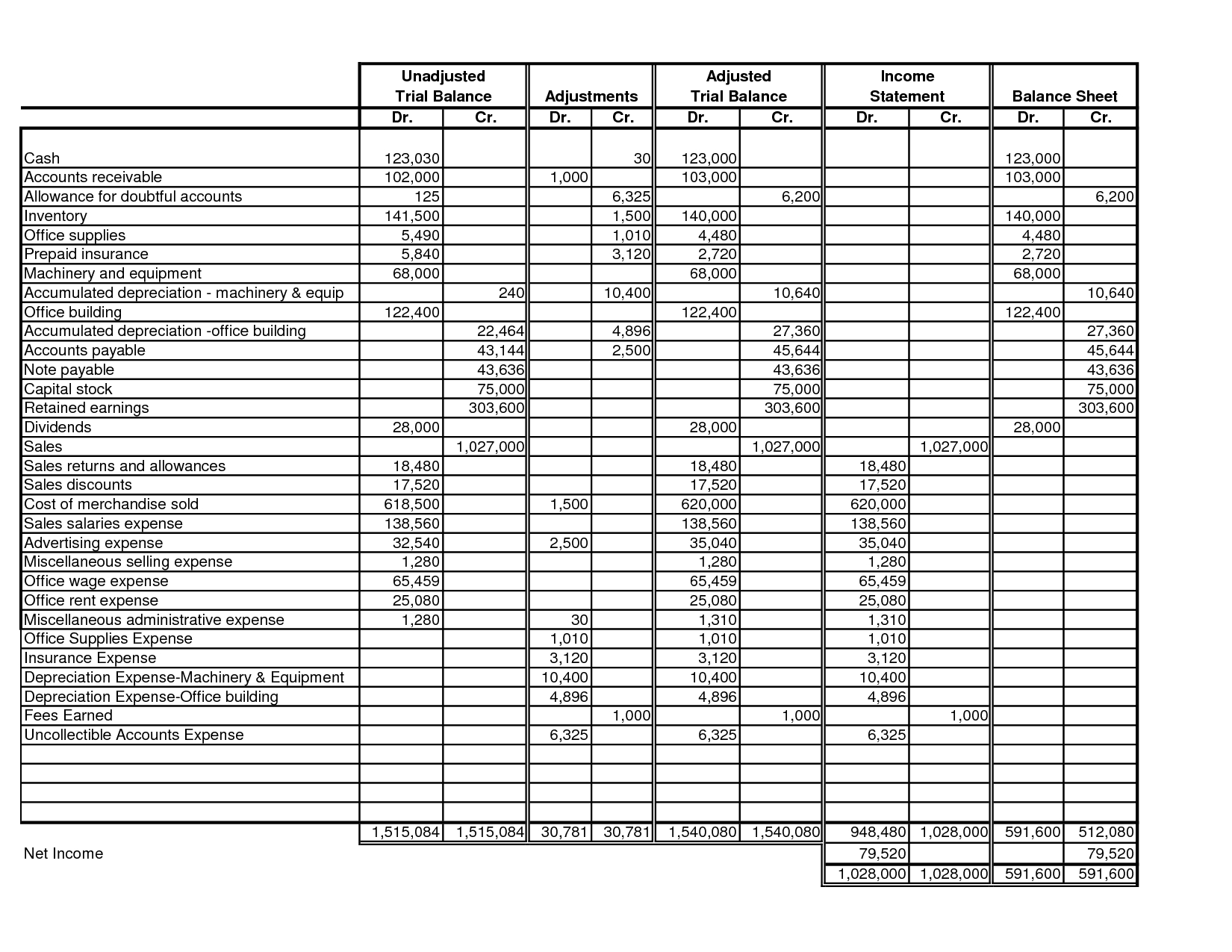

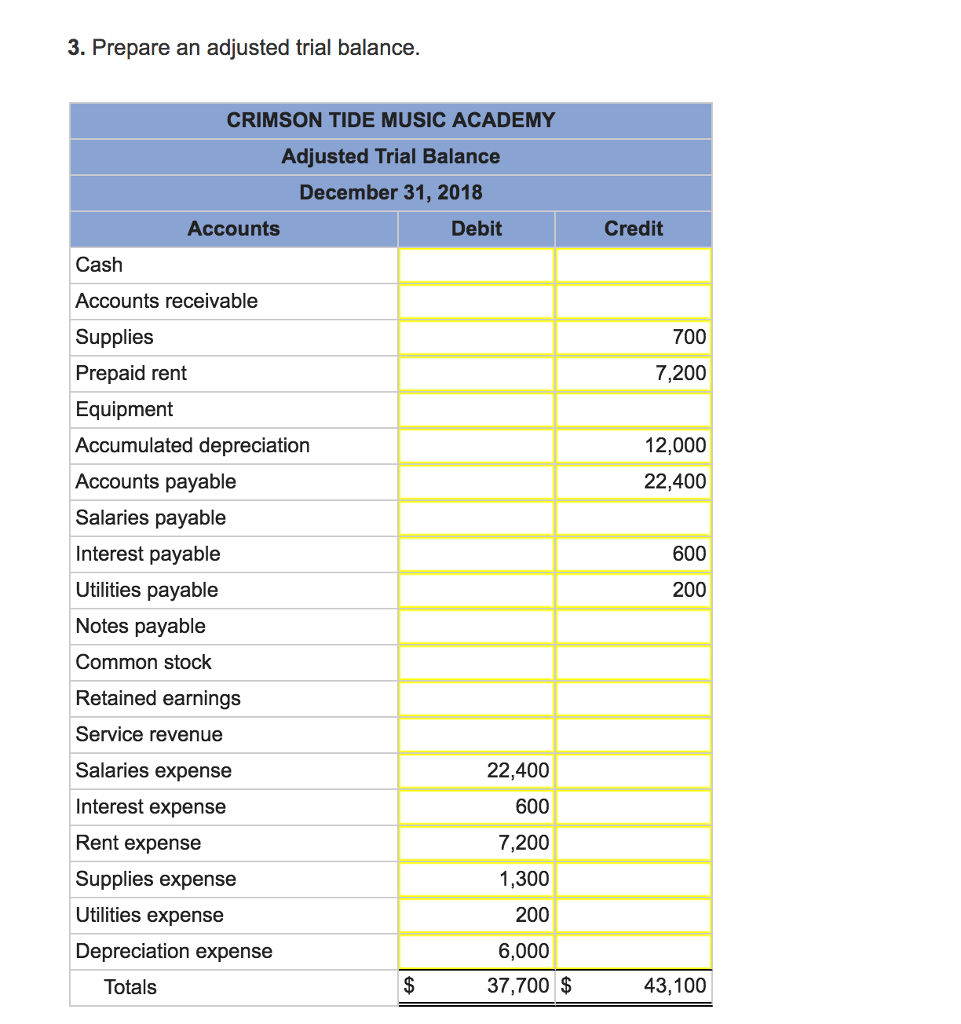

Understanding the Adjusted Trial Balance

The adjusted trial balance is a vital report that lists all general ledger accounts after adjusting entries have been made. It ensures that revenues and expenses are accurately recorded in the correct accounting period, adhering to the accrual accounting principle. This report is the foundation for creating the income statement. (adjusted trial balance, accrual accounting, general ledger)

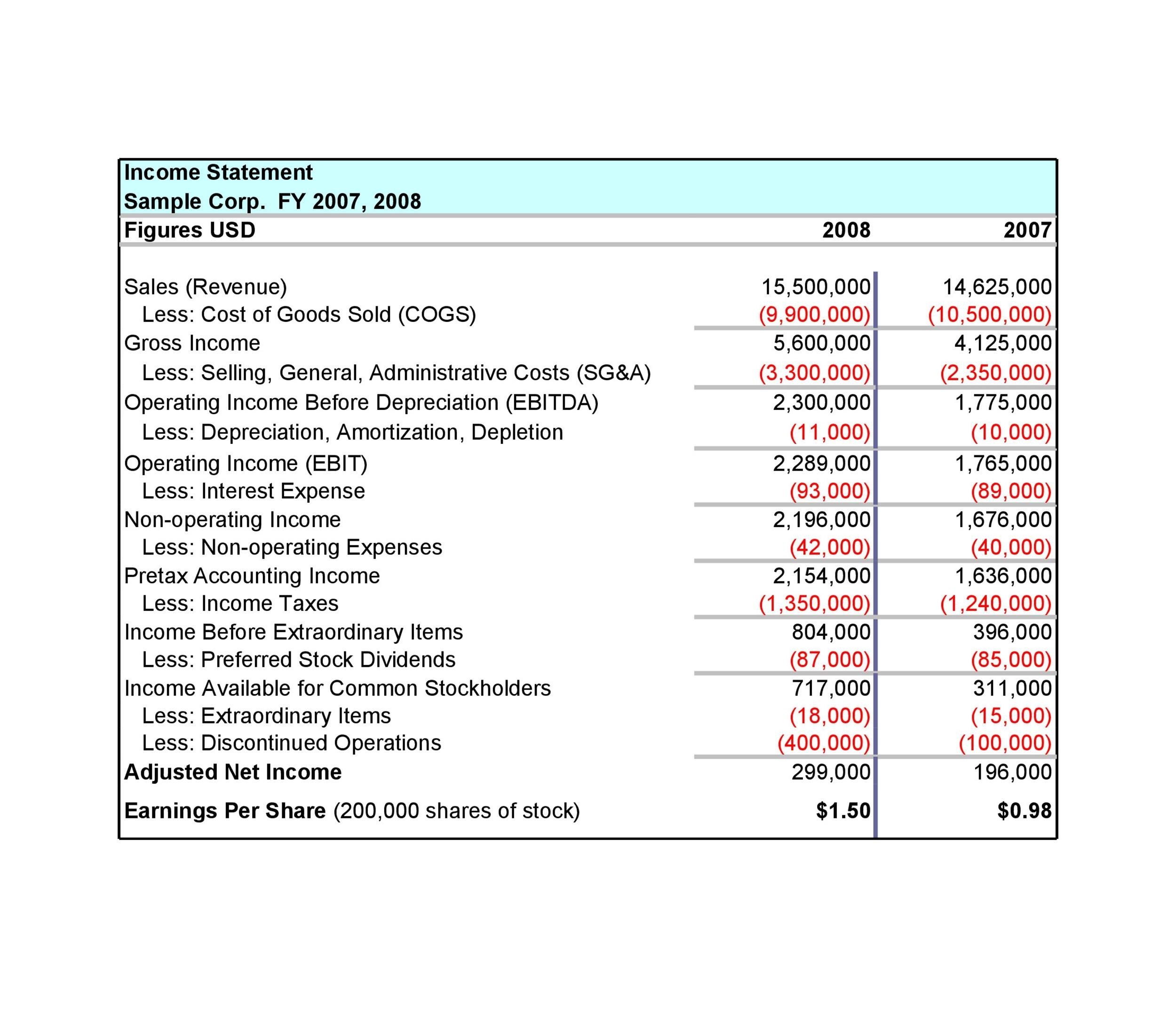

Key Components of the Income Statement

The income statement summarizes a company’s revenues and expenses over a period, ultimately showing the net profit or loss. Key components include:

- Revenues: Total income generated from sales or services.

- Expenses: Costs incurred to generate revenue.

- Net Income/Loss: The final result after subtracting expenses from revenues.

📌 Note: Ensure all revenues and expenses are classified correctly to avoid misstatements. (income statement, revenues, expenses)

Steps to Convert Adjusted Trial Balance to Income Statement

Step 1: Identify Revenue and Expense Accounts

From the adjusted trial balance, separate revenue and expense accounts. These accounts directly impact the income statement. (revenue accounts, expense accounts)

Step 2: Calculate Total Revenues

Sum up all revenue accounts to determine the total revenue for the period. (total revenues)

Step 3: Calculate Total Expenses

Add up all expense accounts to find the total expenses incurred. (total expenses)

Step 4: Compute Net Income/Loss

Subtract total expenses from total revenues to calculate the net income or loss. (net income/loss)

| Step | Action |

|---|---|

| 1 | Identify Revenue and Expense Accounts |

| 2 | Calculate Total Revenues |

| 3 | Calculate Total Expenses |

| 4 | Compute Net Income/Loss |

Tips for Accuracy

To ensure your income statement is accurate:

- Double-check all account balances in the adjusted trial balance.

- Classify accounts correctly as revenues or expenses.

- Use accounting software to minimize manual errors.

📌 Note: Regularly reconcile accounts to maintain accuracy. (accounting software, account reconciliation)

Converting an adjusted trial balance to an income statement is straightforward once you understand the process. By following these steps and tips, you can ensure your financial statements accurately reflect your business’s performance. This clarity is crucial for decision-making and stakeholder communication. (financial statements, business performance)

What is an adjusted trial balance?

+

An adjusted trial balance is a report that lists all general ledger accounts after adjusting entries have been made, ensuring accuracy in financial reporting. (adjusted trial balance)

Why is the income statement important?

+

The income statement shows a company’s profitability by summarizing revenues and expenses over a period, aiding in financial analysis. (income statement, profitability)

How do I classify accounts in the income statement?

+

Revenue accounts increase net income, while expense accounts decrease it. Proper classification is key to an accurate income statement. (revenue accounts, expense accounts)