Calculate Contribution Margin: A Quick Guide

Understanding your contribution margin is crucial for any business looking to assess the profitability of its products or services. It’s a key metric that helps you determine how much revenue exceeds variable costs, providing insights into financial health and pricing strategies. Whether you’re a small business owner or a financial analyst, mastering this calculation is essential for informed decision-making.

What is Contribution Margin?

The contribution margin is the difference between sales revenue and variable costs. It represents the amount of money available to cover fixed expenses and generate profit. A higher contribution margin indicates greater profitability potential.

How to Calculate Contribution Margin

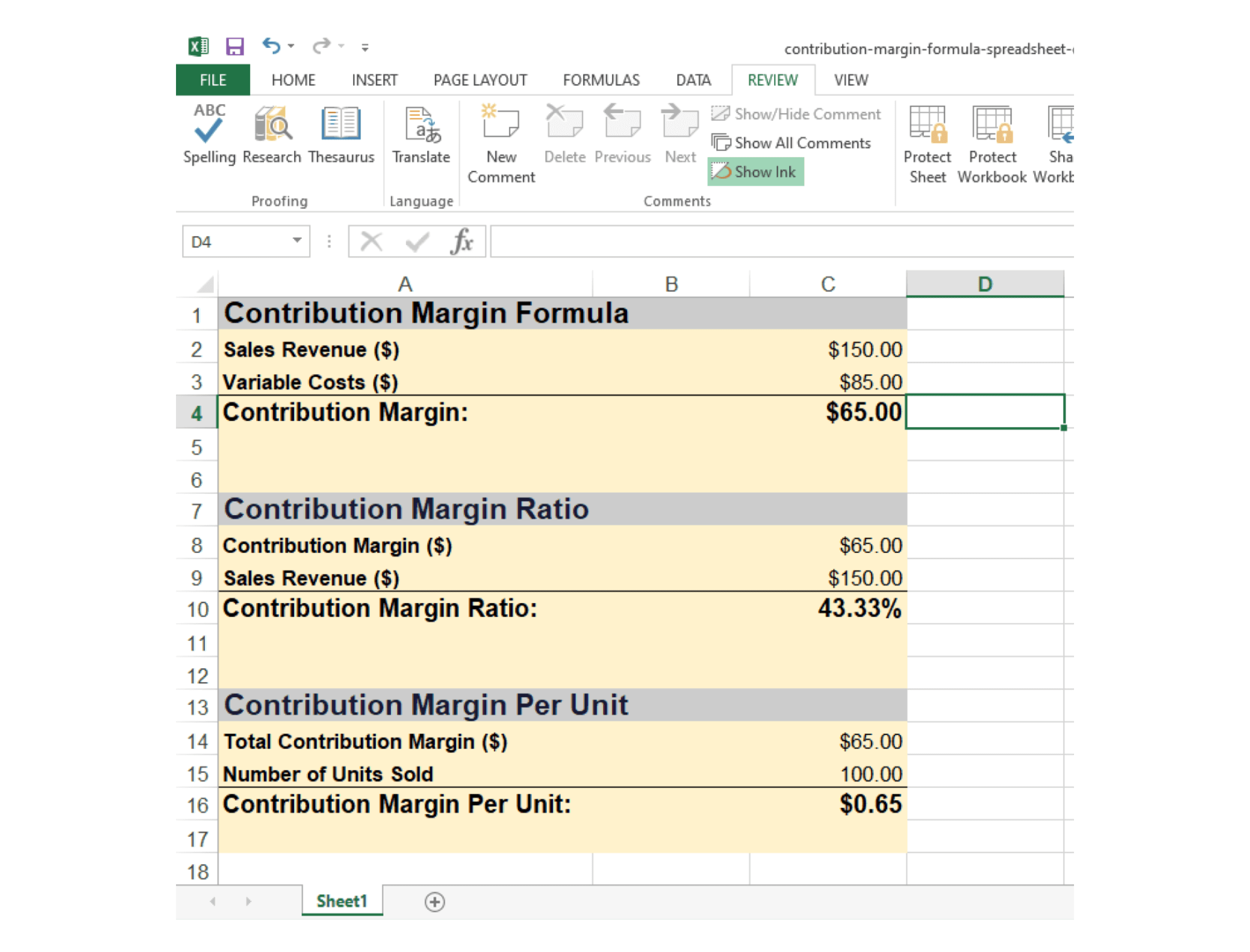

Calculating contribution margin is straightforward. Follow these steps:

Identify Sales Revenue

Determine the total revenue generated from selling a product or service.Calculate Variable Costs

Sum up all costs that vary with production or sales volume, such as raw materials, labor, and shipping.Apply the Formula

Use the formula:

Contribution Margin = Sales Revenue – Variable CostsCalculate Contribution Margin Ratio (Optional)

To express contribution margin as a percentage of sales, use:

Contribution Margin Ratio = (Contribution Margin / Sales Revenue) × 100

📌 Note: Ensure variable costs are accurately identified to avoid skewing results.

Why Contribution Margin Matters

Understanding contribution margin helps businesses:

- Set Optimal Prices: Determine the minimum price needed to cover costs and generate profit.

- Evaluate Product Profitability: Identify which products contribute most to overall profitability.

- Make Informed Decisions: Guide decisions on production, marketing, and resource allocation.

Contribution Margin vs. Gross Margin

While both metrics assess profitability, they differ in scope:

- Contribution Margin focuses on variable costs.

- Gross Margin considers all production costs, including fixed expenses.

| Metric | Focus | Formula |

|---|---|---|

| Contribution Margin | Variable Costs | Sales Revenue – Variable Costs |

| Gross Margin | Total Production Costs | (Sales Revenue – COGS) / Sales Revenue × 100 |

Checklist for Calculating Contribution Margin

- [ ] Gather accurate sales revenue data.

- [ ] Identify and sum up all variable costs.

- [ ] Apply the contribution margin formula.

- [ ] Calculate the contribution margin ratio (if needed).

- [ ] Analyze results to inform business decisions.

In summary, calculating contribution margin is a vital step in assessing product profitability and overall financial health. By understanding this metric, businesses can make smarter pricing, production, and strategic decisions.

What is the difference between contribution margin and profit margin?

+Contribution margin focuses on variable costs, while profit margin considers all expenses, including fixed costs, to determine overall profitability.

Can contribution margin be negative?

+Yes, if variable costs exceed sales revenue, the contribution margin will be negative, indicating a loss on the product or service.

How often should I calculate contribution margin?

+It’s beneficial to calculate contribution margin regularly, such as quarterly or annually, to monitor profitability trends and adjust strategies as needed.

contribution margin calculation, financial metrics, business profitability, pricing strategy