Michigan Take Home Pay Calculator: Calculate Your Net Income Easily

Understanding your take-home pay is crucial for financial planning, budgeting, and making informed decisions about your income. Whether you’re a Michigan resident or just curious about how taxes and deductions affect your paycheck, a Michigan take-home pay calculator can simplify the process. This tool helps you calculate your net income by accounting for federal, state, and local taxes, as well as other deductions like Social Security and Medicare.

Why Use a Michigan Take-Home Pay Calculator?

A Michigan take-home pay calculator is an essential tool for anyone looking to understand their net income after all deductions. It provides a clear picture of how much money you’ll actually receive in your paycheck, helping you budget effectively and plan for the future.

- Accuracy: Ensures precise calculations based on Michigan’s tax rates and deductions.

- Convenience: Saves time compared to manual calculations.

- Customization: Allows you to input specific details like filing status, allowances, and additional withholdings.

How to Use a Michigan Take-Home Pay Calculator

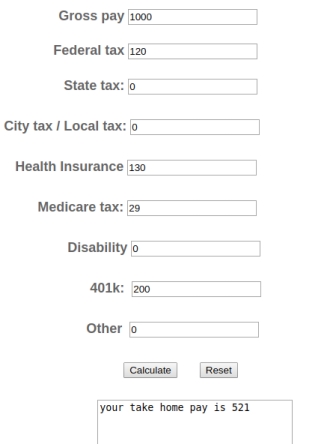

Using a Michigan take-home pay calculator is straightforward. Follow these steps to determine your net income:

- Input Your Gross Income: Enter your annual salary or hourly wage.

- Select Your Filing Status: Choose whether you’re single, married, or head of household.

- Add Allowances: Specify the number of allowances you claim on your W-4 form.

- Include Additional Withholdings: If applicable, add any extra amounts withheld from your paycheck.

- Calculate: Click the calculate button to see your estimated net income.

💡 Note: Ensure all inputs are accurate for the most reliable results.

Key Deductions in Michigan Paychecks

Understanding the deductions from your paycheck is vital to using a Michigan take-home pay calculator effectively. Here are the main deductions you’ll encounter:

- Federal Income Tax: Based on your taxable income and filing status.

- State Income Tax: Michigan has a flat state income tax rate.

- Social Security and Medicare: Mandatory deductions for most employees.

- Other Deductions: May include health insurance, retirement contributions, or garnishments.

Benefits of Knowing Your Net Income

Calculating your net income with a Michigan take-home pay calculator offers several advantages:

- Budgeting: Helps you allocate funds for expenses, savings, and investments.

- Financial Planning: Allows you to set realistic financial goals.

- Tax Preparation: Provides insights into your tax liabilities and potential refunds.

Checklist for Using a Michigan Take-Home Pay Calculator

To make the most of a Michigan take-home pay calculator, follow this checklist:

- [ ] Gather your gross income details.

- [ ] Verify your filing status and allowances.

- [ ] Include any additional withholdings or deductions.

- [ ] Double-check all inputs for accuracy.

- [ ] Review the results to understand your net income.

Wrapping Up

A Michigan take-home pay calculator is an invaluable tool for anyone looking to understand their net income and manage their finances effectively. By accounting for taxes and deductions specific to Michigan, this calculator provides accurate and reliable results. Whether you’re planning your budget or preparing for tax season, knowing your take-home pay is the first step toward financial clarity.

What is a Michigan take-home pay calculator?

+A tool that calculates your net income after deducting taxes and other withholdings specific to Michigan.

How accurate is a Michigan take-home pay calculator?

+It’s highly accurate when provided with correct inputs like gross income, filing status, and allowances.

Can I use this calculator for other states?

+This calculator is tailored for Michigan, but similar tools are available for other states.

Michigan take-home pay calculator, net income, financial planning, budgeting, tax deductions, paycheck calculator.